In the Doghouse

Search

In the Doghouse

Delivering Alcohol-Related Harm to Student Doorsteps

August 27, 2013

Just in time for the new school year, online startup DrinkDrivers.com is marketing its product: hand-delivery of alcohol to college students on demand. The company currently targets students at the University of Central Florida (with plans to expand statewide) to shop online for a variety of beer, wine, and spirits including 24-packs of beer and large kegs.

To complete their orders, students enter their dorm room or housing location and their alcohol will be delivered shortly at all hours of the night. The delivery zone (AKA the DrinkDriving Battlefield or Blast Zone) is the UCF campus, extending outward 6 miles from the center.

According to CEO Jeffrey Nadel, if students run out of alcohol at a party, they can keep the party going without having to get behind the wheel of a car and go to the liquor store. A group just needs a single person age 21 or older to accept the order, and an entire party - fraternity, sorority, residential life, student organization, or any group - can continue binging all through the night. As the company's tagline says: Alcohol to your doorstep.

To make matters worse, DrinkDrivers.com claims that because it brings the party to college students, its (student) customers are less likely to drink and drive.

Misleading and deceptive much? Delivering alcohol to college student's doors is not supported by research showing it decreases DUI, or other alcohol-related harm for that matter. It may actually increase dangerous and/or illegal consumption and unsafe consequences.

It seems DrinkDrivers CEO Nadel may not have noticed, or paid attention to, the real public health data regarding college student drinking. Nationwide, alcohol use is a primary public health problem for college student populations. Death, unintended injuries, various types of violence and assault, sexually transmitted diseases, and academic problems are just some of the most commonly cited alcohol-related harm that college students experience. UCF is definitely not immune to those same issues. Like most colleges and universities, UCF has battled alcohol-related harm for years, and have dedicated efforts to attempt to decrease the harm alcohol causes its students.

Meanwhile, as classes begin and 60,000 UCF students flood the campus, DrinkDrivers.com is strongly pushing its delivery service with lots of free swag (free branded koozies, anyone?) and even contests with giveaways such as free bottles of Grey Goose.

As DrinkDrivers states in their marketing, “Yes, this is real. Yes, it really is that easy.”

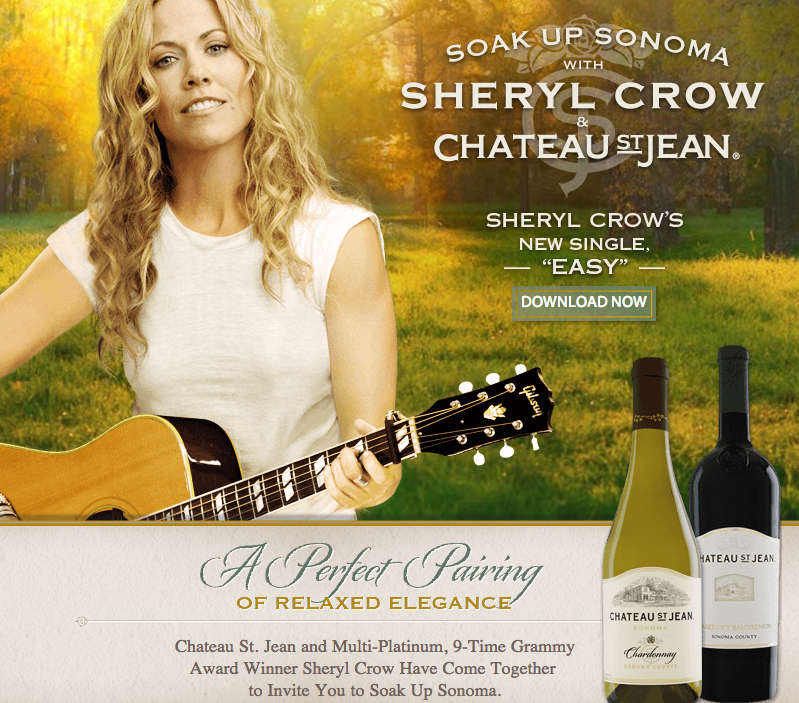

If It Makes You Wealthy: Sheryl Crow & Treasury Wine Estates Sell Out Women’s Health

August 6, 2013

After spending years promoting women’s health causes, breast cancer survivor Sheryl Crow just signed a contract that could very well compromise the progress she has fought for. Crow, one of the country’s top female performing artists, has entered into a partnership with Treasury Wine Estates, one of the world’s largest wine producers, to promote its brand Chateau St. Jean. As part of the deal, Crow is headlining Treasury Wine’s ill-conceived “Soak up Sonoma” promotional campaign, requiring her to take part in in-store promotions, social media initiatives, and free music downloads of her songs. Despite the focus on Sonoma, Treasury Wine is actually an Australian conglomerate whose other California brands include Beringer, Cellar No. 8, Etude, Greg Norman Estates, Meridian, St. Clement, Sbragia, and Stags' Leap Winery.

Perhaps the most hypocritical part of Treasury Wine’s campaign is its claim to health promotion. As part of the deal, Treasury is offering access to recipes from Crow’s new cookbook, If It Makes You Healthy. The book's recipes are each paired with Chateau St. Jean wines, giving the public the impression that drinking alcohol is an essential part of healthful eating. Yet posing alcohol in this way is inaccurate at best: alcohol consumption is an important risk factor for breast cancer, even at levels of 3 drinks per week. There is no safe threshold for alcohol consumption and breast cancer risk. Treasury Wine’s attempts to link wine consumption with healthy living is the latest specific example of the dangerous trend toward questionable health claims by alcohol companies.

Which brings us to yet another troubling facet of this promotional campaign: Treasury Wine's statement that it will donate up to $100,000 to breast cancer charities, an amount associated with sales of Chateau St. Jean during the month of October. The sum pales in comparison to the economic and social cost of alcohol-attributable breast cancer in the United States, given that $100,000 would not likely cover the total costs of direct care for one woman with breast cancer during the course of her treatment. In fact, direct care specifically for breast cancer in the U.S. cost $16.5 billion in 2010.

This promotion is a classic example of pinkwashing, a term coined by Breast Cancer Action to describe corporate campaigns in which the sponsoring company positions itself as a leader in the fight against breast cancer while engaging in practices that contribute to the rising rates of the disease. Alcohol companies that engage in pinkwashing are using a good cause to cash in, while distracting from the evidence linking alcohol consumption to breast cancer risk.

Promoting alcohol as a healthy product is a harmful public relations tactic used to grow positive feelings toward the brands, the producers, and the industry as a whole – and increase sales. With this partnership, cancer advocate Crow is applying her considerable celebrity capital to increase sales of a product that contributes to the incidence of breast cancer in women. Treasury Wine Estates is exploiting breast cancer as a public health problem, and posing as a health advocate, in order to sell more of that product.

The promotion is a mockery of breast cancer survivors and their loved ones, as well as a mockery of public health, breast cancer advocacy, and alcohol policy.

DART Misses the Mark on Transit Alcohols Ads

July 16, 2013

Faced with a budget crunch in 2011, the Dallas Area Rapid Transit (DART) board of directors voted to throw out its commitment to public safety and accept alcohol advertisements. Initially, ambiguity in the Alcoholic Beverage Code delayed implementation of the new policy. Now the issue has been settled, and DART officials are looking to cash in. After June 14, when Texas Governor Rick Perry signed an amendment to the Texas Alcoholic Beverage Code into law that will explicitly allow alcohol advertising to be displayed on public transportation vehicles in the state, DART officials wasted no time announcing that the transit agency will now accept alcohol advertisements.

Faced with a budget crunch in 2011, the Dallas Area Rapid Transit (DART) board of directors voted to throw out its commitment to public safety and accept alcohol advertisements. Initially, ambiguity in the Alcoholic Beverage Code delayed implementation of the new policy. Now the issue has been settled, and DART officials are looking to cash in. After June 14, when Texas Governor Rick Perry signed an amendment to the Texas Alcoholic Beverage Code into law that will explicitly allow alcohol advertising to be displayed on public transportation vehicles in the state, DART officials wasted no time announcing that the transit agency will now accept alcohol advertisements.More Articles ...

Help us hold Big Alcohol accountable for the harm its products cause.

| GET ACTION ALERTS AND eNEWS |

STAY CONNECTED    |

CONTACT US 24 Belvedere St. San Rafael, CA 94901 415-456-5692 |

SUPPORT US Terms of Service & Privacy Policy |

Copyright © 2024 Alcohol Justice. All Rights Reserved.

Joomla! is Free Software released under the GNU General Public License.