June 10, 2024

Read more

February 13, 2024

Read more

February 13, 2024

Read more

February 13, 2024

Read more

February 13, 2024

Read more

November 20, 2023

Read more

November 20, 2023

Read more

November 19, 2023

Read more

June 21, 2023

Read more

February 28, 2023

Read more

October 18, 2022

Read more

October 18, 2022

Read more

September 1, 2022

Read more

August 15, 2022

Read more

February 11, 2022

Read more

February 11, 2022

Read more

February 11, 2022

Read more

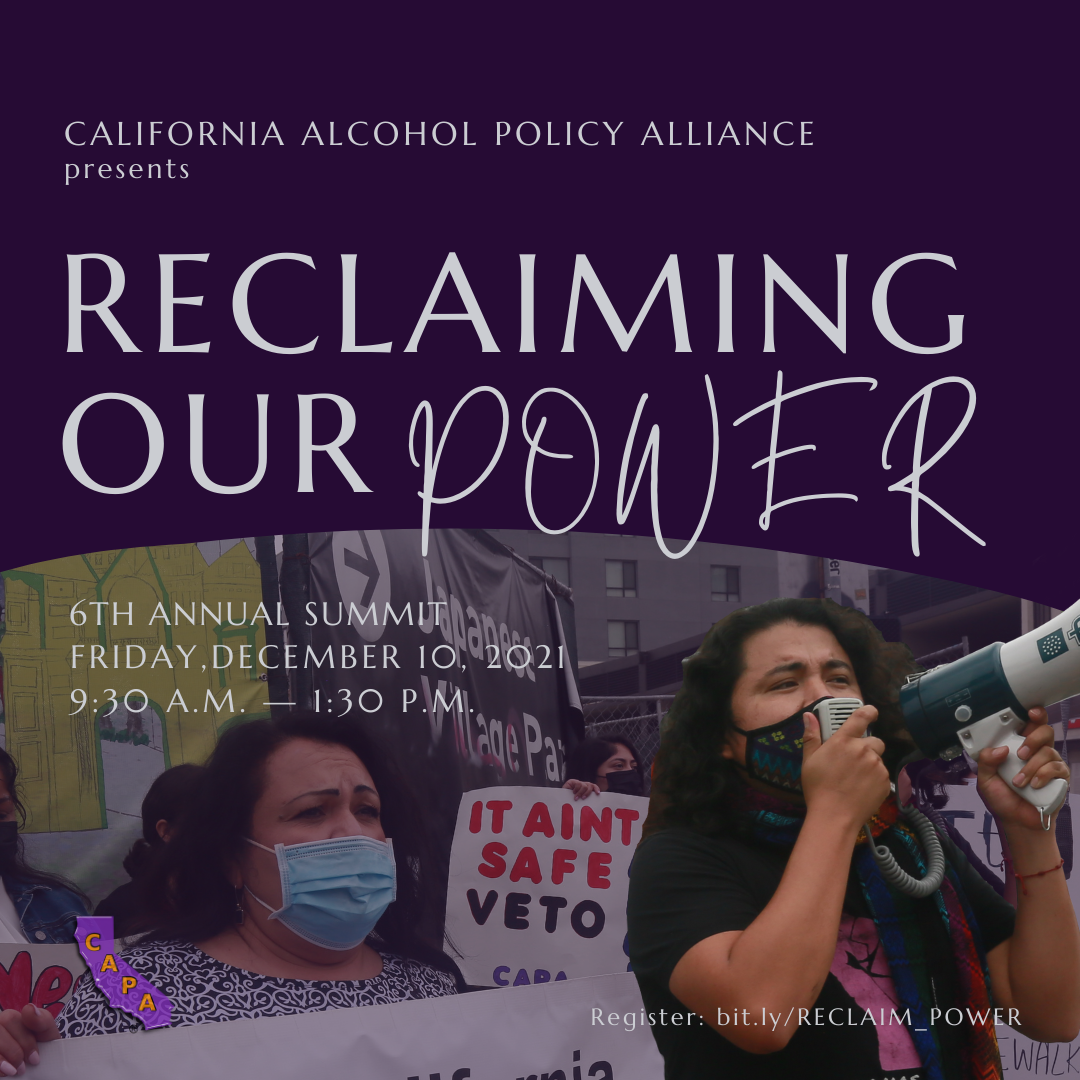

December 8, 2021

Read more

November 29, 2021

Read more

November 24, 2021

Read more

November 24, 2021

Read more

November 21, 2021

Read more

March 22, 2021

Read more

December 23, 2020

Read more

December 22, 2020

Read more

December 18, 2020

Read more

November 24, 2020

Read more

October 28, 2020

Read more

July 13, 2020

Read more

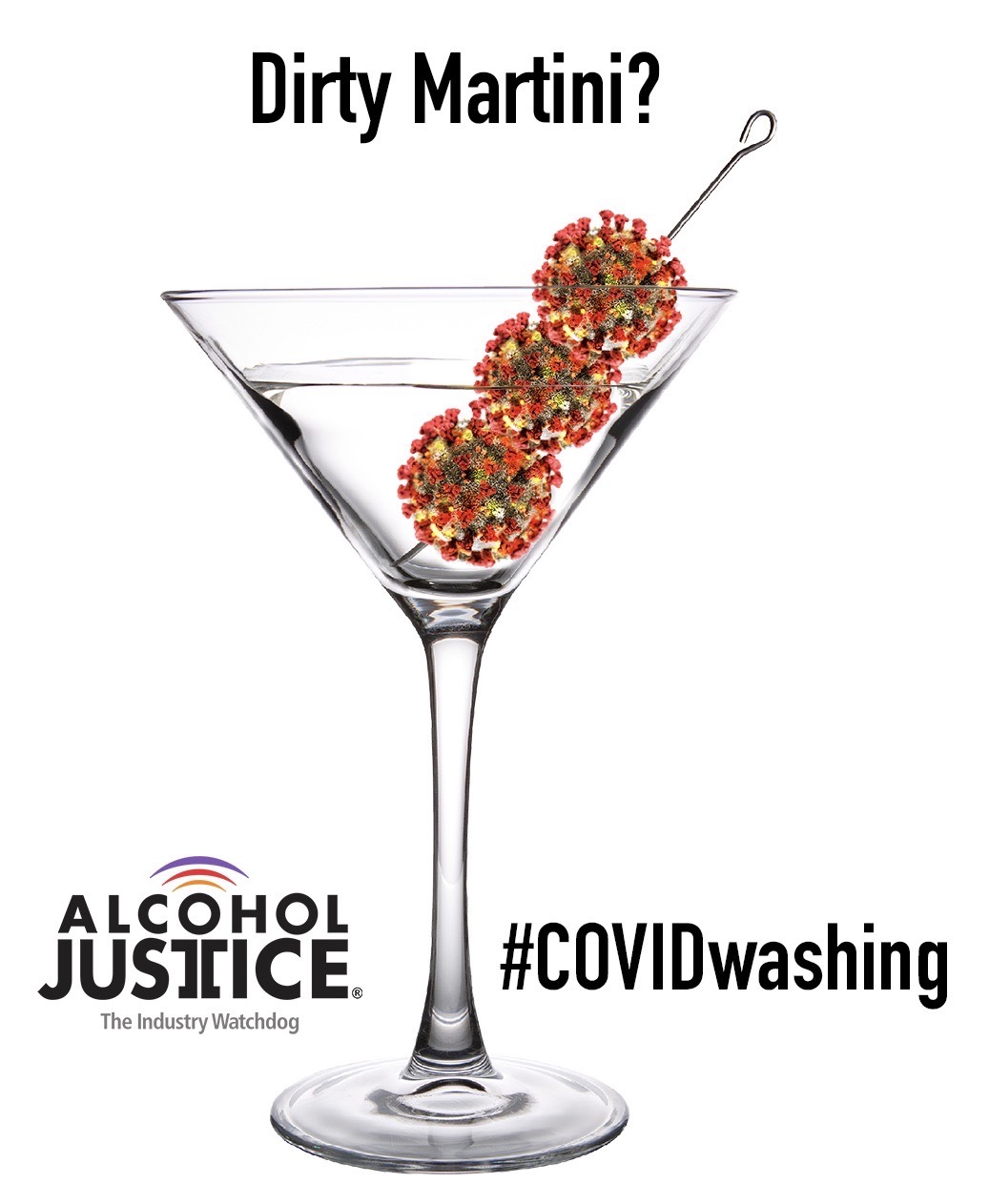

March 21, 2020

Read more

March 18, 2020

Read more

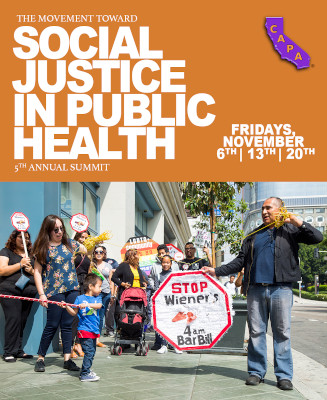

May 10, 2019

Read more